Get the free irp5 certificate download pdf download

Show details

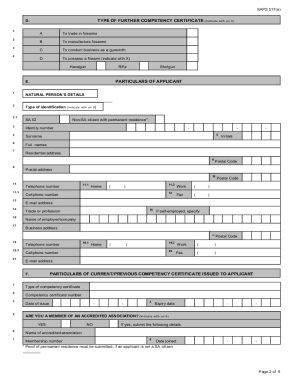

The employer may use his/her own logo. Under no circumstances may the employer use the SARS logo IRP 5 EMPLOYEES TAX CERTIFICATE / WERKNEMERSBELASTINGSERTIFIKAAT EMPLOYER INFORMATION / WEAKENER INSISTING

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pr5 form

Edit your where do i get irp5 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irp5 certificate download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sars irp5 form download online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit rp5 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rp5 sars form

How to fill out irp5 form:

01

Gather all necessary information and documents, including your personal details, employment information, and income details.

02

Access the relevant form online or obtain a physical copy from your employer or the tax authority.

03

Start by accurately filling in your personal details, such as your name, address, and tax identification number.

04

Provide all relevant employment details, including your employer's name, address, and tax reference number.

05

Fill in your income details, including any salary, bonuses, allowances, or deductions.

06

Ensure that all the information you provide is accurate and matches the records of your employer.

07

Double-check your completed form for any errors or missing information before submitting it.

08

Submit the filled-out irp5 form to your employer or the relevant tax authority, following their specific guidelines and deadlines.

Who needs irp5 form:

01

Individuals who are employed by a company or organization and receive a salary or other form of remuneration.

02

Employees who wish to accurately report their income and ensure compliance with tax regulations.

03

Employers who are required to issue irp5 forms to their employees for the purpose of tax reporting and record-keeping.

04

Tax authorities who use irp5 forms to assess and verify individual taxpayers' income and tax liability.

Fill

download irp5 form

: Try Risk Free

What is irp5 form?

An IRP5 is the employee's tax certificate that is issued to him/her at the end of each tax year detailing all employer/employee related incomes, deductions and related taxes. It is used by the employee specifically to complete his/her income tax return for a specific year.

People Also Ask about irp5 form download

Can I download my IRP5?

Dumisane, If you are a 10X client, you can download your IRP5 from our Reporting Portal. If not, you must request this from your responsible fund administrator. The information and answers supplied in this section do not constitute advice as defined by the Financial Advisory and Intermediary Services Act, 37 of 2002.

Where can I get IRP5?

If so, which IRP5/IT3(a)number must I use? If you have requested your IRP5 or IT3(a) certificate from the employer / ex-employer and the employer has failed to provide such, you must visit the nearest SARS branch or call the Contact Centre for advice pertaining to the steps to be taken.

How do I retrieve old IRP5?

If you have requested your IRP5 or IT3(a) certificate from your employer / ex-employer and the employer has failed to provide such, you can book a virtual appointment or call 0800 00 7277 to book a branch visit for advice on the next steps.

How do I get IRP5 in South Africa?

If you have requested your IRP5 or IT3(a) certificate from your employer / ex-employer and the employer has failed to provide such, you can book a virtual appointment or call 0800 00 7277 to book a branch visit for advice on the next steps.

What is the meaning of RP5?

RP5 Model means the document of that name, prepared and published by the Authority following consultation with the Licensee (which consultation may take place before or after this condition comes into force), which sets out the principles and methodology for determining the actual entitlement for RP5 in respect of each

What is PR5 form?

Internal Staff Fees (PR5) form These payments are processed monthly and therefore if submitted on time the claimant will be paid with the end of month pay run.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my irp5 form download pdf directly from Gmail?

sars irp5 form download pdf and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I complete irp 5 form online?

pdfFiller has made it simple to fill out and eSign irp5 certificate. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out rp5 form on an Android device?

Complete irp5 form pdf and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is irp5 form?

The IRP5 form is a tax certificate issued by employers in South Africa, which details an employee's income and the taxes deducted during the tax year.

Who is required to file irp5 form?

Employers in South Africa are required to issue an IRP5 form for all employees from whom they have deducted tax during the tax year.

How to fill out irp5 form?

To fill out the IRP5 form, employers must input employee details, earnings, and deductions accurately as per remuneration records, and ensure the information aligns with the tax legislation.

What is the purpose of irp5 form?

The purpose of the IRP5 form is to provide employees with a record of their income and tax deductions for a specific tax year, which they can use to file their personal income tax returns.

What information must be reported on irp5 form?

The IRP5 form must report employment income, deductions for tax, and any other relevant remuneration information, including bonuses, overtime, and fringe benefits.

Fill out your irp5 certificate download pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

irp5 Form is not the form you're looking for?Search for another form here.

Keywords relevant to ipr5 form

Related to it3a certificate template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.